The physical and mental health challenges surrounding debt

The physical and mental challenges experienced as a consequence of debt can, for many people, be overwhelming. In addition, mental health and debts are two issues that people feel uncomfortable discussing, making a difficult situation even worse. For those suffering a financial crisis it is crucial to find someone with whom they can discuss their concerns, and take positive action.

Some of the primary mental and physical challenges of debt include a loss of direction/purpose, difficulty knowing how to get out of debt and taking back control. Many people feel that their life is no longer their own; they are battling to survive but drowning in a sea of debt. Consolidating debt NZ is often a valuable means of regaining control, recognising the issues and taking action.

This article will look at the physical and mental health challenges and what you can do to take more control.

Can debt impact your physical well-being?

Many people associate financial issues with mental health problems, but evidence suggests they can also cause physical health issues. Those who have suffered financial problems will likely associate with the physical health challenges listed below.

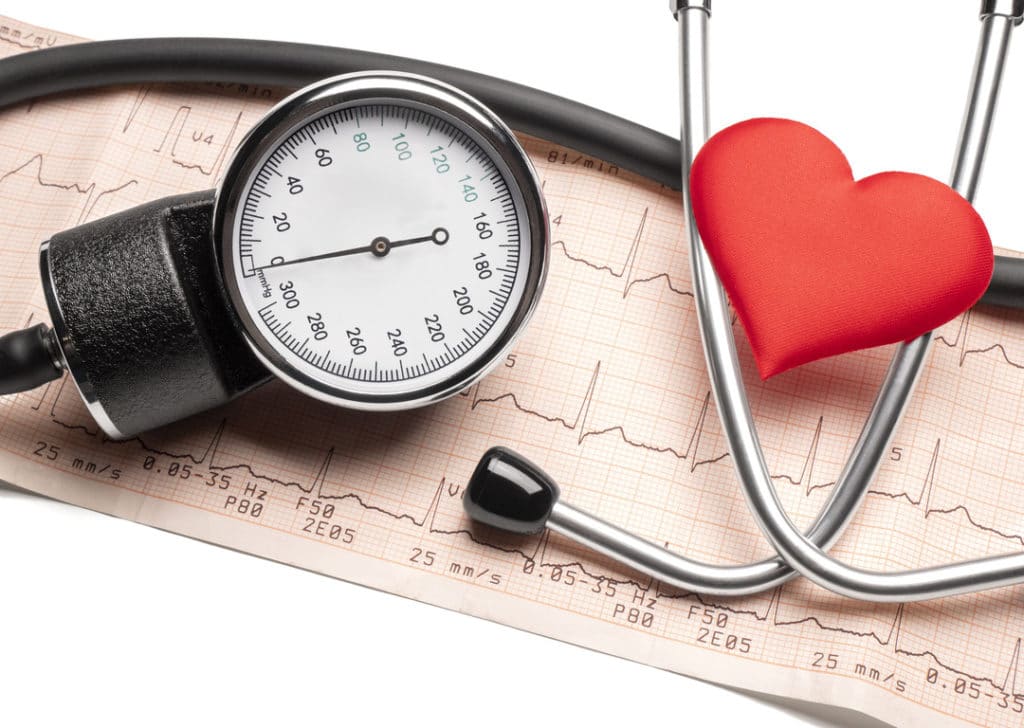

High blood pressure

There have been numerous studies carried out worldwide, which have created a powerful link between financial pressure and high blood pressure. Historically, many people assumed that high blood pressure only impacted those in the older age brackets, but this is not the case. Studies have shown that even adults aged 24 to 32, with debt problems, registered above-average blood pressure.

High blood pressure can bring about several additional health issues such as heart disease and strokes. Therefore, you must visit your doctor for a check-up because this condition can be fatal if left untreated.

Insomnia

Those who experience insomnia, often brought about by stress, have real trouble sleeping at night-time. This can lead to a vicious circle. Difficulty sleeping at night forces many to grab a few hours of sleep through the day, which makes night-time sleeping even less likely. We know that sleep is crucial to the brain, giving your mind time to analyse and store your thoughts and memories, and lack of sleep is a serious issue.

Sleep deprivation may then lead to other issues such as fatigue, inability to focus and even changes in your personality. Do not underestimate the power of sleep!

Mood changes

Those suffering from financial issues will likely experience stress, which can have a knock-on effect on their mood and personality. The subject of how to get out of debt is often on their mind 24/7, which isn’t healthy. As a result, they can become impatient, snappy and in some cases downright rude to other people. Unfortunately, many surveys have highlighted that these mood swings can impact personal, family and working relationships.

Like the body’s natural fight or flight reaction, you will find that many people suffering from stress become withdrawn and, for want of a better word, antisocial. While they usually have friends and family they can talk to, cutting themselves off from the people who would generally help makes a difficult situation even worse.

Change in diet

As a consequence of added pressure and lack of sleep, those with financial worries often see a change in their diet. This can be exacerbated because of fatigue, which leads to reduced levels of physical exercise. Consequently, sufferers may also gain weight as the vicious cycle begins – depression can start to creep in with weight gain.

While you may not feel like exercising, you must push yourself, even just going for a walk. We know that endorphins released when exercising and in the open air have a very positive effect on your mood. Turning around your mindset so that you are more positive than negative is a significant factor in tackling debt.

Recent studies have shown that unhealthy food is often cheaper than healthy food in New Zealand. This is due to a number of factors, including the high cost of fresh produce and the availability of cheap, processed foods that are high in sugar, fat, and salt.

One of the primary reasons why unhealthy food is cheaper than healthy food in New Zealand is the cost of production. Processed foods are often mass-produced, using cheap ingredients and methods of preparation that can be easily replicated on a large scale. On the other hand, fresh produce requires more resources and labor to grow, harvest, and transport, which results in higher costs.

Another factor contributing to the high cost of healthy food in New Zealand is the country’s geographic isolation. As an island nation, New Zealand relies heavily on imported goods, which can be expensive due to transportation costs and import tariffs.

Additionally, healthy food options like fresh fruits and vegetables are often sold at premium prices in New Zealand due to limited availability and high demand. This means that many people, particularly those on a low income, are forced to rely on cheaper, less nutritious options.

The high cost of healthy food in New Zealand has serious consequences for public health. A diet high in processed foods and low in fresh produce has been linked to a range of health problems, including obesity, diabetes, and heart disease. These health issues can be particularly devastating for people on low incomes, who may not have access to quality healthcare or the resources to manage chronic illnesses.

Can debt impact your mental well-being?

Unfortunately, far too many people already know the answer to this question; yes, debt can impact your mental well-being. However, the most significant challenge with mental health is recognising the problem. For example, if you have a broken arm, this type of physical injury is evident. However, if you’re suffering from mental health issues, these may not be so visible. Consequently, those with mental health challenges are often dismissed as having “nothing wrong with them”.

We will now take a look at the various mental health challenges associated with financial pressures.

Anxiety

The first thing to realise about anxiety is that we experience stress and anxiety in everyday life, and it is perfectly healthy. It is only when anxiety begins to rule your life that it becomes a problem. For example, we know that anxiety can lead to high blood pressure and other physical illnesses, but mental stress can be too much for many people.

The most common way anxiety will present itself is a constant worry of issues such as money and everyday life (things you previously controlled). This can have a massive impact on your daily decision-making functionality, often leading to more stress and significant mental pressure. Therefore, it is vital to approach your doctor when you feel anxious to begin treatment as soon as possible.

Depression

Those who have suffered depression in their lifetime often only realise after they have come through this darkness. There are many descriptions of depression, but the most common is probably a “constant dark cloud hanging over you”. Like other mental illnesses, many of those who suffer from depression will withdraw themselves from friends, family and even work colleagues. This then exacerbates a feeling of loneliness, and the vicious circle begins.

There is evidence to suggest that depression can have a physical impact on your brain. This can range from inflammation to oxygen restriction, often impacting your nervous system. It can also affect your short-term memory and ability to make rational decisions.

Loss of confidence

When experiencing any degree of mental stress, this can prompt you to doubt yourself in areas where previously you had strong confidence in your abilities. Unsurprisingly, this can have a massive impact on your working life and sometimes lead to difficulties in the workplace. If you are suffering financial problems, the last thing you want to do is put your job at risk, for many people, their primary income.

We are starting to see a pattern emerging here. Mental health issues, such as loss of confidence, especially in the workplace, quickly lead to a vicious circle. Once you address the anxiety/depression issues you may be experiencing; this should help improve your self-confidence. The fightback begins!

How to get out of debt

Research shows that those struggling financially will often have several individual debts, whether this is a personal loan, unpaid utility bills or other financial liabilities. When you miss one financial payment, this can have a knock-on effect on others and very quickly, it can become a significant problem. Therefore, you must face your issues head-on and take advice about how to get out of debt.

Recognising the problem

You can use different strategies when considering how to get out of debt, but you need to recognise the problem before you can fix it. There is no point in putting your head in the sand, hoping all of your financial worries will disappear; this won’t happen. Once debt depression grabs hold, it can be tough to shake off. Instead, recognise your problems, calculate your liabilities and take action.

Consolidating debt NZ

In some cases, it may be possible to take action before your financial situation runs out of control. Unfortunately, this is not always possible as sometimes financial issues can quickly emerge, having a devastating knock-on effect. The majority of us will have overdrafts, credit cards, personal loans and other financial liabilities. Many of these will involve minimum monthly payments, which can be relatively small in isolation but rather large when added together.

Consolidating debt NZ involves paying off your existing debts using one loan, often referred to as a consolidation loan. This means that you only have one minimum payment, although the amount will reflect the consolidation of all your financial liabilities. Here at Crester Credit, we offer highly competitive rates for those looking at consolidating debt NZ which can help put you back on the road to financial recovery.

Re-evaluate your spending habits

If you cannot afford your debts at the moment, you will need to make changes to your spending habits. The option of consolidating debt NZ will not be open to you unless you can prove the repayments are sustainable in the longer term. This may involve missing out on some of the luxuries of life until you get back on your financial feet. A small price to pay for reduced physical and mental pressure?

The physical/mental challenges of debt are real

Financial pressure can lead to an array of physical and mental challenges, which can sometimes be life-changing. Therefore, it would be best to address any financial worries sooner rather than later and avoid what many describe as debt depression. Mental stress can lead to vicious circles, resulting in greater and greater mental pressure. Consequently, it is essential to take action as soon as you see any financial difficulties on the horizon.

As a responsible lender, we would never saddle you with an unaffordable loan. We prefer to look at the broader picture, debts, assets and liabilities and see where we can assist. The sooner you look to address any financial problems, the more options available to you. Please don’t leave it too long!

by Ash Horton

July 26, 2021

Ash is a professional content writer with extensive experience in business development in the financial services. Ash has founded businesses from the age of 19, including franchising ventures, and working alongside some of the largest retailers in the world.