Bad Credit Loans

If you have a history of bad credit, it can swiftly become almost impossible to get a loan. The loans that others take for granted such as a hire purchase loan for a new fridge or a car loan are out of reach for many people who have a bad credit history. This is unfortunate, as it often takes the realisation that you’re not being wise with your money before people will go out and educate themselves on how to manage their finances better. With some financial literacy knowledge, people should then be able to take on loans if they believe they can pay them back. With most lenders, this is not the case. However, Crester Credit is proud to provide bad credit loans for people who deserve a second chance provided they can afford it.

What Is A Bad Credit Loan?

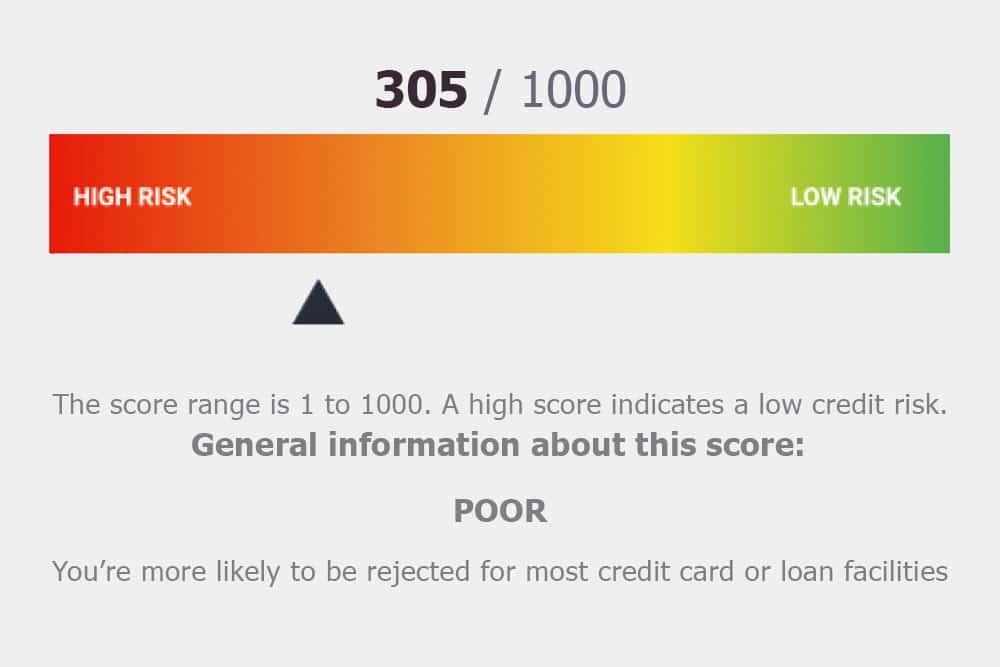

A bad credit loan is any loan given to an individual who doesn’t have a good credit score. There are plenty of reasons why someone might have bad credit. Maybe they missed some mortgage payments when they were made redundant. Maybe when they were young, they got a credit card and didn’t pay it off.

There are numerous reasons why people could have a bad credit score, whether it was out of their control or not. However, for some people, this will haunt them forever as it can be near impossible to get a loan in the future.

The Side Effects of a Bad Credit Rating

What’s wrong with having a bad credit rating? Many consequences come from this which follow people throughout the rest of their lives. These include:

- Not being approved for a mortgage – many banks simply won’t take the risk that someone with bad credit will be able to repay a mortgage. This can keep you stuck in the rental cycle and prevent you from getting onto the property ladder.

- Not being able to access a car loan – maybe it’s finally time that your trusty old car needs to be sent to the wreckers. Imagine not being able to get the finance approved to buy another second-hand car – that’s exactly what would happen if you had bad credit.

- Paying more for insurance – car, home, and contents insurance can all cost more for people with bad credit. Unfortunately, insurance agencies see these people as a risk and charge them more accordingly.

- Being passed over for job opportunities – employers will often do a credit check before approving a hiring decision. If you have bad credit and can’t seem to get another job, this could be why.

The combination of these consequences that come from having a bad credit score can keep people in the cycle of consistently not having enough money. This can cause them to take out loans with incredibly high interest rates from loan sharks who will lend to just anyone. And so, the cycle continues – their credit remains bad, they need to borrow from the loan sharks again, and so on.

Does Crester Credit Offer Bad Credit Loans?

If you’re never given a chance to improve your credit score, it will remain bad for the rest of the foreseeable future. How will you ever get a mortgage or have anyone take the chance of investing in your incredible business idea?

Here at Crester Credit, we think that it’s completely unfair to judge people on their past. Many people with bad credit have worked hard to pay off debt and improve the way they manage their money. That’s why we don’t lend to just anyone, but we do help people by giving them a second chance.

By no means do we promise to loan to anyone and everyone with bad credit. Instead, we are committed to responsible lending practices. This means that while we may not take your bad credit score in to account, we will loan to you only if you can realistically pay off the loan in the time period specified. We aim to help people out of tough situations, not keep them in a consistent cycle of debt.

Applying for a Bad Credit Loan

Instead of applying for a bad credit loan with Crester Credit, we’ve made applying for a personal loan a simple alternative. Just take a look at our handy loan calculator to figure out how much you can afford to pay back each week and it will tell you how much you can borrow. This way, you will know upfront what you’re paying for the loan and how long it will take you to pay it off.

When you’re ready to apply, fill out the online application form. One of our friendly team will be in touch to discuss your circumstances. Then they approve the loan or not, depending not on your credit score, but your ability to repay the loan. It’s as easy as that! So, contact Crester Credit today to discuss how we can help you out of the cycle of bad credit.

by Ash Horton

September 24, 2020