Paying Off Debt Faster: How to use compound Interest to get out of debt faster!

Introduction:

Kia ora, fellow Kiwis! 🥝 In the land of New Zealand, where Middle-Earth came alive and rugby is almost a religion, there’s another player demanding our attention, a financial one – compound interest. While it may not compete with the scenic allure of the Southern Alps, it’s a force to reckon with in the financial arena. If you have a loan of any kind and want to pay it off sooner rather than later, it is a must to understand the ins and outs of compound interest. Ready to dive into its intricacies and get a grip on your debt and pay it off faster?

The ABCs of Compound Interest: Why Every Kiwi Should Care

Compound interest is, at its core, the interest on interest. Imagine if every dollar you owed (or saved!) had baby dollars. Those baby dollars then grow up and have their own little dollar offspring. It sounds cute until you realise those dollars might be munching away at your wallet!

If you’re keen to see it in action, the Compound Interest Calculator is an eye-opening tool.

Debt’s Sneaky Climb: Understanding How It Grows in the Kiwi Landscape

So, how does compound interest relate to the average Joe or Jane in NZ? Let’s say you’ve got a credit card debt that you’re not quite chipping away at. With every month that you only pay the minimum, you’re not just accruing interest on your original debt, but also on the interest that debt has already generated. Before you know it, your debt has silently scaled to Mount Cook proportions! But lets look into it with a bit more detail, because it can honestly be a challenge to understand in the beginning!

Unraveling the Magic and Mystery of Compound Interest in Car Loans and More

New Zealanders, known for their love of long drives through scenic routes, often invest in cars. But financing these rides, especially if one isn’t aware of the intricacies of compound interest, can be tricky. Just as compound interest can work wonders in multiplying your savings, it can also silently inflate your debt when you’re on the borrowing side. Let’s take a journey down the car loan lane and uncover the real cost of borrowing when compound interest comes into play.

Zooming into the Car Loan Landscape

It’s not uncommon for individuals to seek car loans when contemplating buying a new vehicle. With various financing options available, what really determines the affordability of a loan is its interest type, rate, and repayment plan.

The Real Cost of Compound Interest: A Car Loan Story

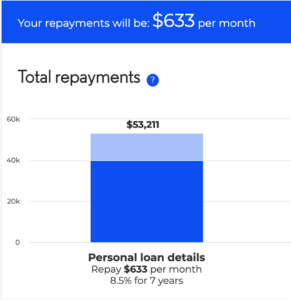

Imagine you’ve taken out a car loan for NZD 40,000 to buy your dream car. This loan has an interest rate of 8.5%, and you’re expected to pay it back over 7 years. Let’s simplify what this could mean for you:

When you take out a loan, and if you choose to only pay the smallest amount they ask for every month (known as the minimum payment) for the whole 7 years, the amount you owe grows because of something called compound interest. It’s a bit like a snowball rolling down a hill, gathering more and more snow.

So, for your car loan of NZD 40,000, because of this compound interest, by the end of 7 years, the total you’d end up owing is NZD 53,211 This means you’d actually be paying an extra NZD 13,211 on top of the original amount you borrowed for the car.

Reality of loan repayments with compound interest.

It is also important to note, that this isn’t including any additional account fees, late payment fees or any increase of interest rate throughout the term of the loan.

I’m sure you can now see why it is so important to understand how compound interest works, so you know exactly what you’re getting into when borrowing money and what actions you can take to avoid staying in debt for longer than needed!

Navigating the Pitfalls of Minimum Payments

When borrowers focus solely on minimum monthly payments, they often overlook the big picture. By only covering the minimum, you’re predominantly paying off the interest while barely scratching the surface of the principal. This strategy prolongs the loan’s life, making you pay significantly more over time due to compound interest. Essentially, you’re in a longer, costlier financial commitment than you anticipated.

Rev Up Your Repayment Strategy

It’s obvious from our example that understanding compound interest is crucial. To shield yourself from its negative effects:

- Accelerate Your Payments: Consider paying more than the minimum amount. This approach chips away at the principal faster, reducing the amount on which interest accrues.

- Refinance if Necessary: If you find a lender offering a lower interest rate, refinancing your car loan might be a viable option. It could save you a significant sum in the long run.

- Stay Informed: Always be aware of your outstanding loan amount, interest rate, and the duration left. This knowledge helps in strategising repayments effectively.

- Negotiate Your Terms: Negotiate, negotiate, negotiate! Chat with your loan provider about adjusting your terms so they are in your favour. Things you can do is get a lower interest rate or change the interest compounding from monthly to annually to save on the interest you pay.

Discover Competitive Low-Interest Rate Loans with Crester Credit!

In the bustling world of finance, finding the perfect loan with favorable terms can be a challenging task. At Crester Credit, we pride ourselves on offering competitive low-interest rate loans tailored to suit your needs. Whether you’re eyeing that new car, dreaming of a house renovation, or simply needing a financial cushion, we’re here to guide you every step of the way. Our commitment is to provide transparency, trustworthiness, and top-tier customer service. Feel free to reach out today and easily apply online for our loans!

Cruising to the Conclusion

While New Zealand’s picturesque landscapes beckon for long drives in your dream car, it’s essential to understand the long-term financial landscape of your car loan. Compound interest, when left unchecked, can turn your car-buying dream into a financial nightmare. By being proactive, informed, and strategic about repayments, you can ensure that your ride remains joyous, both on the road and on paper. Remember, in the realm of loans, knowledge truly is the power to steer clear of unwanted financial bumps.

by Ash Horton

November 7, 2023

Ash is a professional content writer with extensive experience in business development in the financial services. Ash has founded businesses from the age of 19, including franchising ventures, and working alongside some of the largest retailers in the world.